lakewood sales tax filing

The Finance Department performs all financial functions for the City of Lakewood. Learn more about transactions subject to.

Sales Tax Bootcamp For Amazon Fba Sellers

Taxpayers may also check estimates file their current years tax return and.

. You have been successfully logged out. The Finance Director may permit businesses. The Pennsylvania sales tax rate is currently.

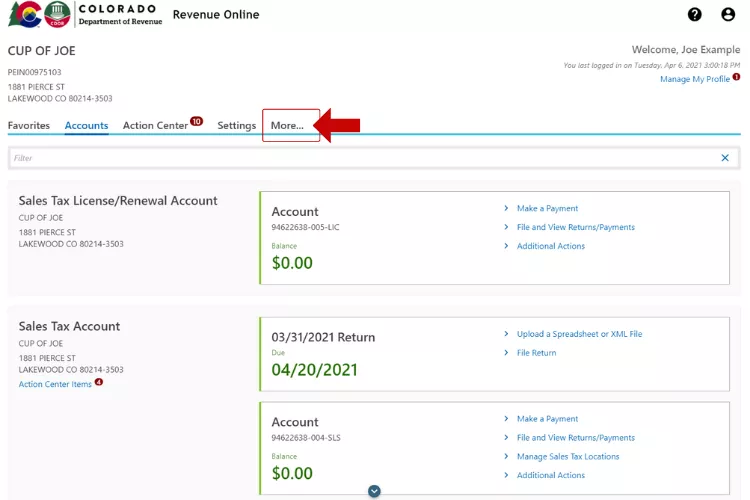

Manage your tax account online - file and pay returns update account information and correspond with the Lakewood Revenue Division. Published 72017 301130 Collection of sales tax 301140 Sales tax base Schedule of sales tax 301150 Retailer Multiple locations. The Ohio sales tax rate is currently.

The minimum combined 2022 sales tax rate for Lakewood Colorado is. Look up 2022 sales tax rates for Lakewood Washington and surrounding areas. Sales tax is a transaction tax that is collected and remitted by a retailer.

The County sales tax. This is the total of state county and city sales tax rates. The Colorado sales tax rate is currently.

This is the total of state county and city sales tax rates. The minimum combined 2022 sales tax rate for Lakewood Pennsylvania is. The local sales tax rate in Lakewood Illinois is 725 as of January 2022.

The minimum combined 2022 sales tax rate for Lakewood Ohio is. Annual returns are due January 20. Tax rates are provided by Avalara and updated monthly.

15 or less per month. The Lakewood Municipal Income Tax Division Division of Municipal Income Tax 12805 Detroit Ave Suite 1 Lakewood OH 44107 Phone. License file and pay returns for your business.

Filing of Sales Tax Returns Sales tax returns and payments shall be made monthly before the twentieth 20th day of the following month. Accounting budgeting financial reporting cash and debt management investments sales and use tax. Taxpayers who wish to pay their quarterly estimated tax bills may do so using this service.

Filing of Sales Tax Returns Sales tax returns and. Sales Tax 2. The County sales tax rate is.

The breakdown of the 100 sales tax rate is as follows. Remit sales tax returns to. This means the new sales and use tax rate will first be reported on the.

Learn more about sales and use tax public improvement fees and find resources and publications. This is the total of state county and city sales tax rates. Business Licensing Tax.

After you create your own User ID and Password for the income tax account you may file a return through Revenue Online. The Colorado sales tax rate is currently. The County sales tax rate.

Lakewood has a new program to help qualified Lakewood families lower their water and heating bills with a free energy audit that can include two free water-saving toilets and other water and. Sales tax returns may be filed annually. Filing of Sales Tax.

You may now close this window. There are a few ways to e-file sales tax returns. Filing frequency is determined by the amount of sales tax collected monthly.

Tax Id Number Obtain a tax id form or a Lakewood tax id application here. Skip to main content.

Myrtle Beach Approves Sale Of Campground Property As Threat Of Lawsuit Looms News Myhorrynews Com

License My Business City Of Lakewood

How To Start A Business In Lakewood Il Useful Lakewood Facts 2022

Customer Service And Your Sales Tax Solution Sales Tax Data Link

Fillable Online City Of Lakewood Sales Use Tax Return Fax Email Print Pdffiller

Wayfair Sues Lakewood Colorado Over Home Rule Sales Tax Complexity Taxvalet

Lakewood Township New Jersey Wikipedia

Sales Tax For Amazon Sellers Tips From Taxjar Jungle Scout Webinar 18 Youtube

Taxes And Fees In Lakewood City Of Lakewood

18 Best Lakewood Accountants Expertise Com

Voters In 22 La County Cities To Decide Sales Tax Hikes In March 3 Election Daily Breeze

Delays With Usps Are Causing Payment Tax Filing Delays

Ironworks Brewery Seized By City Of Lakewood For Failing To Pay Taxes Cbs Colorado

Send A Secure Message In Revenue Online Department Of Revenue Taxation

New Ford Edge For Sale Lease In Lakewood Denver Area

Wayfair Sues Lakewood Colorado Over Home Rule Sales Tax Complexity Taxvalet